A variable annuity cannot. Annuities are financial instruments that earn interest and provide a guaranteed stream of payments over a predetermined amount of time.

New Pension Scheme Pensions Life Annuity Annuity

Ad Learn More about How Annuities Work from Fidelity.

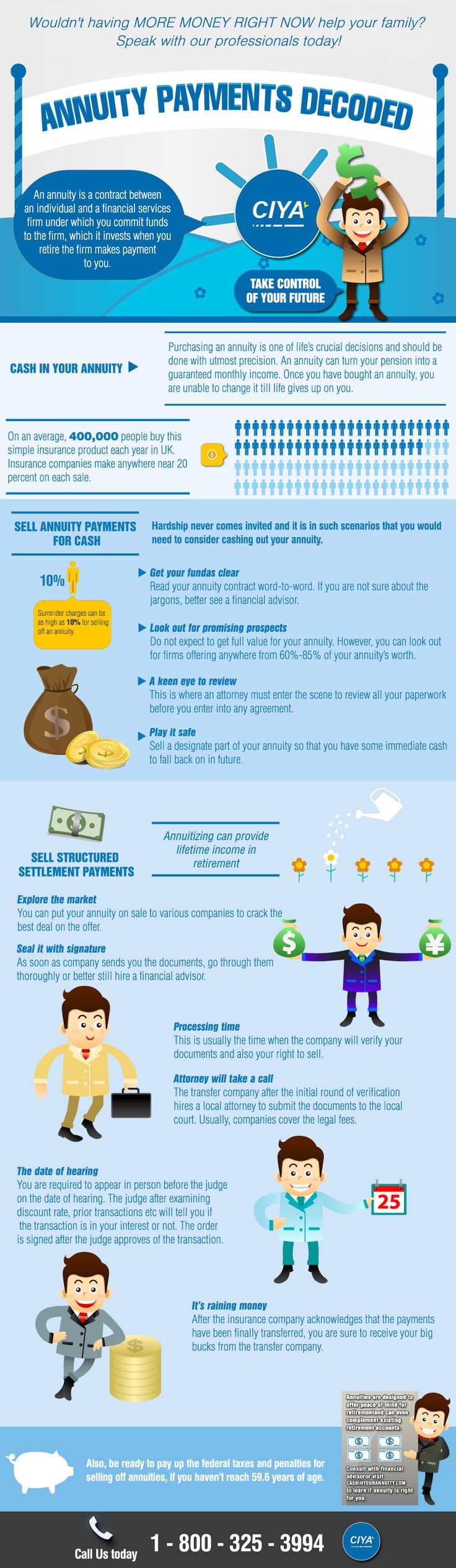

. Annuities can be used for all of the following reasons EXCEPT. The insurance company allows you to direct your annuity payments to different investment options usually mutual funds. An annuity is a financial product that provides certain cash flows.

Registered Annuities can be purchased with. Stocks Mutual and Segregated funds outside RRSPs. Registered Retirement Savings Plan RRSP Locked-in RSP LRSP Registered.

Charitable gift annuities create tax savings. Using capital to purchase income defines which of the following. Ad Learn More about How Annuities Work from Fidelity.

Money in a variable annuity is invested in a fundlike a mutual fund but one open only to investors in the insurance companys variable life insurance and variable annuities. Each variable annuity is. To fund a childs education D.

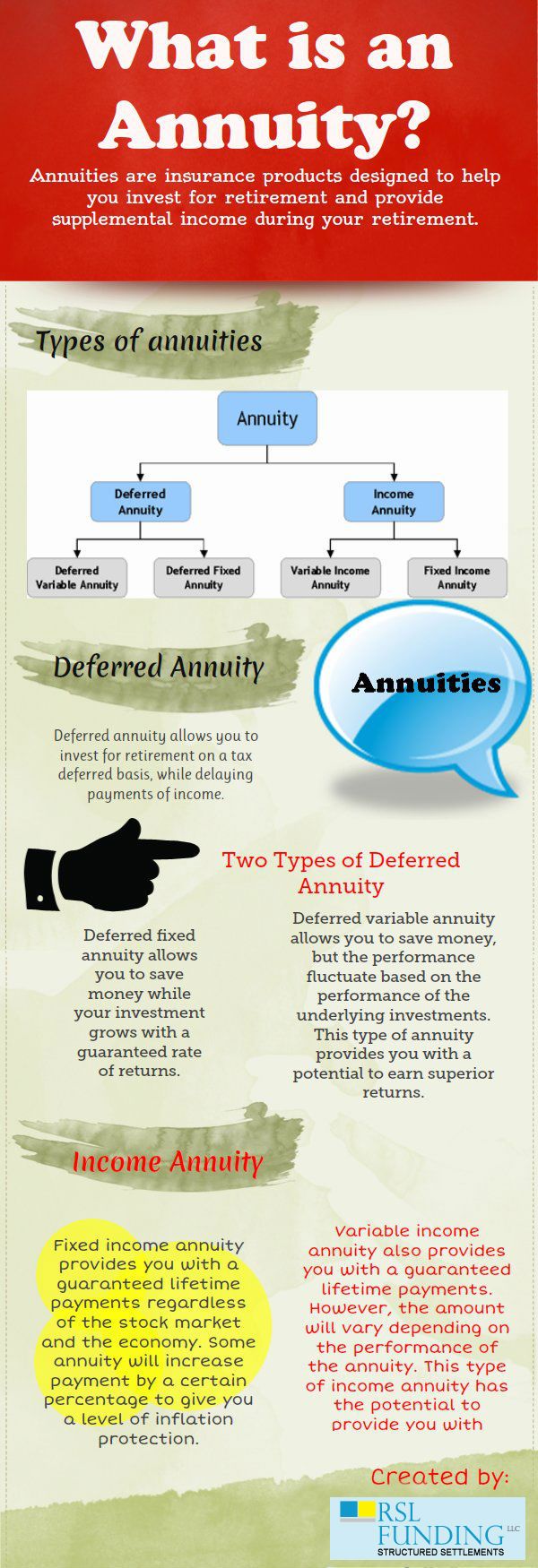

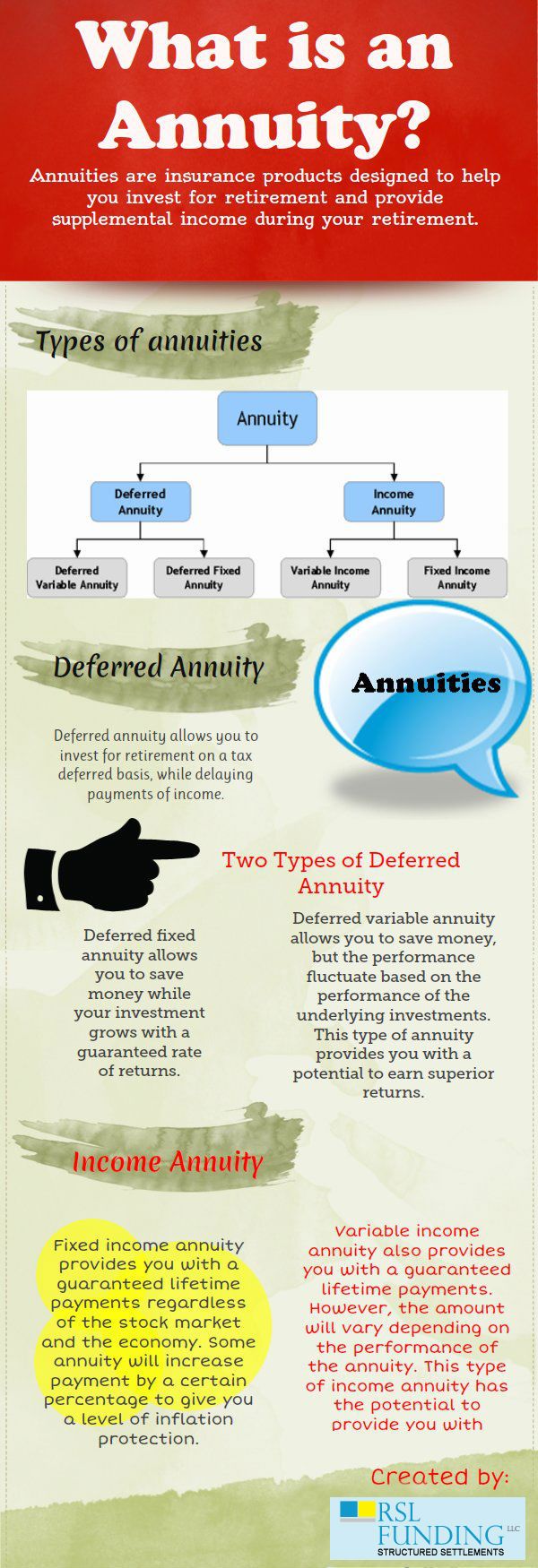

Variable rate deferred annuity. Investors typically buy annuities to provide a steady income stream during retirement. An annuity is often used to fund retirement.

Which of the following account types can not be used to fund a Registered Annuity. A fixed annuity can be used to fund a qualified plan. A deferred annuity has an accumulation phase followed.

Immediate annuities pay income right away while deferred annuities. By doing so you can make a large donation to your favorite charity while also receiving fixed payments for the rest of your life. To liquidate an estate C.

Annuities are insurance contracts that promise to pay you regular income immediately or in the future. To accumulate retirement finds B. Also like CDs MYGAs and other deferred annuities have surrender charges if you withdraw your money early.

2- Which of the following statements regarding a LIF is false. This type of annuity may be funded with cash. The investment options for a variable annuity are typically mutual funds that invest in stocks bonds money market instruments or some combination of the three.

The funds accumulated inside an annuity can be used to fund all or part of a consumers retirement income. Death Benefit annuities guarantee a minimum rate of return to heirs. Annuities may have early withdrawal penalties.

Exchanging monies accumulated in a Deferred. Cash from a maturing Certificate of Deposit CD. Cash Flow Cash Flow CF is the increase or decrease in the amount of money a business institution or individual has.

Your payout will vary depending on how much you. You can fund your deferred income annuity in a number of ways including. Qualified IRA style annuities.

The accumulated funds can be used to purchase a settlement option which. Death benefits - Annuities are most commonly used to fund a persons retirement but they can technically be used to accumulate cash for any reason. To create an estate.

D Cash accumulation for any reason. Variable annuity contracts allow insurers to invest your premiums in mutual funds that comprise stocks bonds and other short-term money market products.

Annuity Annuity Life Insurance Marketing Marketing Humor

Pin By Robbin Davis On Gtk Social Media Planning Financial Advice How To Plan

What Is An Annuity Annuity Investing For Retirement Finance Investing

0 Comments